Income Tax Department of India announced the last date of Pan Aadhaar Linking. If you fail to link your Pan with your Aadhar then your Pan card will become inoperative.

Before 30th June, 2023 you are requested to link the both documents by following our complete step by step process. However it is expected that the last date of Pan Aadhar linking will be extended by competent authority.

Table of Contents

Pan Aadhaar Link Step by Step Process

To link your Pan with Aadhaar you may follow the below steps:

- Visit Income Tax E Filling Portal.

- In left hand side you will get option Link Aadhaar.

- After clicking on Link Aadhaar you will get the below screen where you have to provide your Pan and Aadhar details and click on validate.

- After clicking on validate system shows you the fee that you need to pay to link your Pan with your Aadhaar. Or if your Pan Aadhaar is already linked it will reflect automatically after clicking on validate.

- To make the payment you need to click on Continue to pay Through E-Pay Tax.

- In E- Pay Tax page you have to provide the Pan number and any mobile number then click on continue.

- You will receive an OTP then insert the OTP in the given box and click on continue.

- After Successful OTP verification yu may proceed for Payment by clicking on continue.

- You have to select Income Tax option in the next step and click on proceed.

- Select the Assessment Year 2024-25 and Other Receipts (500) under type of payment head.

- Select Sub-type of Payment: Fee for Delay in linking Pan with Aadhaar and click on continue.

- In next step payable amount rupees 1000 will show in other section you just have click on continue.

- In next payment page you have to select the desire payment mode to make the payment via Internet banking, Debit Card, NEFT/RTGS and UPI etc. Even you will get option to make payment physically in bank counter.

- After clicking on appropriate mode of payment and continue button payment details will reflect in the screen and you just need to click on Pay Now.

- After making the payment challan will be generated.

- Again you have to visit the Home page and click on Link Aadhaar. Then you have to put the Pan and Aadhaar details and continue. Your challan details will reflect here and click on continue.

- In next window, you have to provide your Name as per Aadhaar and click on link Aadhaar.

- In the screen massage will reflect that you Pan Aadhaar is successfully linked.

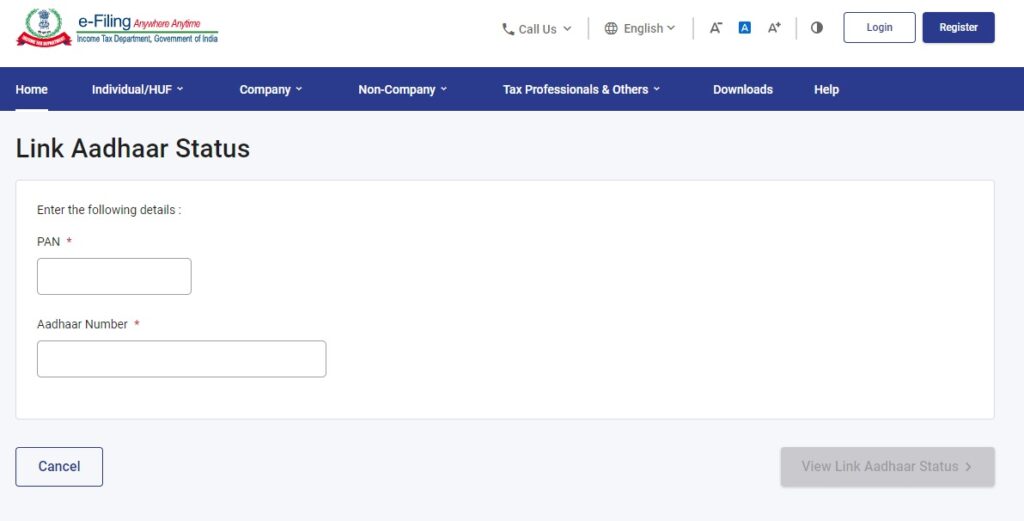

How to check Pan Aadhaar Linking Status online?

You may check the Pan Aadhaar linking status by following the below steps:

- Visit Income Tax official website.

- In left hand side you will get option Link Aadhaar Status and click on it.

- Provide your Pan, Aadhaar number in the given space then click on View Link Aadhaar Status Cancel.

- If Your Pan already linked system will show it automatically.

Exemption in Pan Aadhaar Linking

Following categories are exempted from Pan Aadhaar linking:

- NRIs

- Not a citizen of India

- age > 80 years as on date

- State of residence is ASSAM, MEGHALAYA or JAMMU & KASHMIR.

Refer Department of Revenue Notification no 37/2017 dated 11th May 2017 (Source IT Department of India).

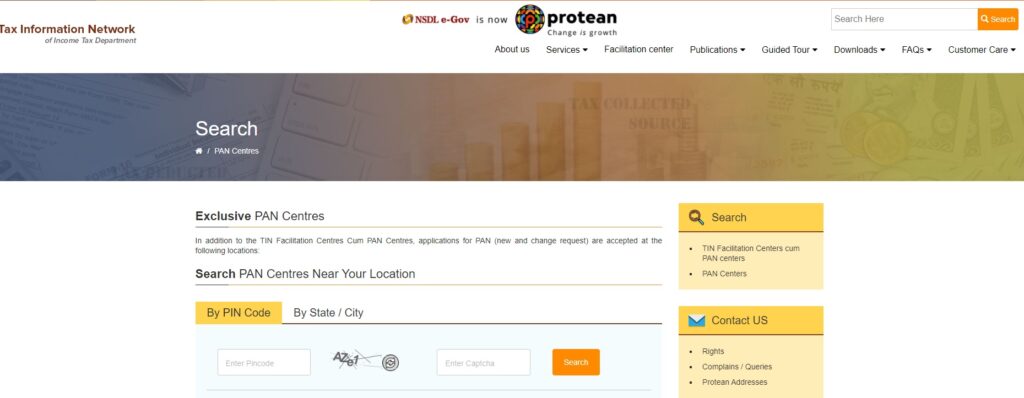

How to Link Pan with Aadhaar if data Mismatch?

If any of your data like Name, DOB and Gender mismatch between Pan and Aadhaar then you may link the two documents via biometric Authentication by physically visiting the Pan centres near you.

You may find the Pan centres by click here. You will get the below page after clicking. Then put your area pin code along with the captcha code then click on search button.

If you proceed for Biometric Authentication for Pan Aadhaar link, then you have to pay additional Rs: 50.00 at the Pan centre to link the both documents. You total cost would be Rs: 1000.00+50.00= 1050.00.

You may also Read: How National Career Service Initiative helps thousands of Jobseekers to get jobs in India.

Consequences of Not Linking your Pan with your Aadhaar

Somehow if you fail to link your Pan with your Aadhaar following will be the consequences:

- Your Pan will become inoperative and if you produce your PAN as KYC then it will not going to be accepted.

- You will not be able to file Income Tax Return.

- If you already filed your ITR then your Processing of the Return will be hold.

- If you supposed to get refund against your ITR filing then your refund will be or hold.

- TDS and TCS will be deducted at higher rate against your PAN.

How to Check you PAN whether it is operative or Non-operative?

Please follow the below steps to check your PAN status:

- Visit Income Tax E Filling Portal.

- In left hand side you will get option Verify your PAN and click on it.

- Provide Your PAN number, Date of Birth and Name as per PAN and provide any mobile number for OTP verification and click on continue.

- You will receive an OTP on the mobile number provided. Put the OTP in the given space and click on continue.

- You will get the status of your PAN whether is is operative or non-operative.

Q&A

1.Question: What is PAN Aadhaar Link Payment Head?

Answer: Other Receipts (500).

2. Question: What is the last date of PAN Aadhaar Link?

Answer: 30th June, 2023 announced by IT Department of India which may or may not extend.

3. Question: Is it mandatory PAN Aadhaar link in Assam?

Answer: No, it is not mandatory but if a person having both of the ID Card PAN and Aadhaar then he or she can link the PAN with Aadhaar without any fee as Assam is Exempted from PAN Aadhaar linking.

4. Question: PAN Aadhaar Link free or Chargeable?

Answer: No, it is not free you have to pay the delay fee.

5. Question: What is the fee for PAN Aadhaar Link?

Answer: Rs: 1000.00 (One Thousand Only)

6. Question: Is PAN Aadhaar linking in Assam is Free?

Answer: Yes, PAN Aadhaar linking is free as of now(i.e July, 2023) in Assam as Assam is Exempted from PAN Aadhaar Linking.

If you have any query and required further support, please do comment below.